10 Tips To Evaluate The Execution Time And Costs Of An Ai-Stock Prediction Tool

Cost of trading, execution times and profit are all significant elements to be considered when evaluating AI stock trade predictors. Here are ten strategies to help you evaluate these elements:

1. Examine the impact of transaction cost on profit

The reason: Costs associated with trading like slippage, commissions and fees can decrease returns particularly for high-frequency traders.

How: Verify if the model takes into account all costs of trading in its profit calculation. Effective predictors model real-world trading costs to ensure real-time performance indicators.

2. Test the model's sensitivity to slippage

What causes slippage? The price fluctuation between the time an order is placed and its execution could negatively impact the profits. This is especially true when markets are in a volatile state.

Make sure the model includes slippage estimates built on order size and market liquidity. Models that adjust dynamically for slippage are more accurate to forecast returns.

3. Examine the frequency of trades with respect to the expected returns

What's the reason? Frequent trading leads to higher transaction costs, which may result in a decrease in net profits.

What can you do to determine if a model's frequency of trading is justified by returns generated. Models that maximize trading frequency have a balance between losses and gains by maximising net profitability.

4. Considerations regarding the impact of markets on large trades

Why: Large trades can alter market prices, resulting in more expensive execution costs.

What is the best way to confirm that the model includes market impact, especially in the case of large orders aimed at stocks with high liquidity. Market impact analysis prevents traders from underestimating their earnings.

5. Assess the time-in-force settings and flexibility of trade duration

How: The time-in force setting (like Immediate, Cancel, or Good Till Cancelled) will affect the execution of trades as well as timing.

How: Verify the model's time-in-force settings for its strategy. This will allow the model to trade at optimal conditions, without excessive delays.

6. Assess latency in relation to execution timing

What is the reason? In high-frequency trading, the delay (between the generation of signals and the trade's implementation) can lead to missed opportunities.

What should you look for in the model to see if it is optimized for low execution latency or whether it factors in possible delays. Reducing latency for high-frequency strategies is critical for accuracy and profitability.

7. Make sure you are monitoring in real-time.

What's the reason? Monitoring trade execution in real-time ensures the prices are in line with expectations which reduces timing effects.

Check that the model supports real-time monitoring of trades to avoid performing them at an the wrong price. This is especially important for volatile assets and strategies which rely on precise timing.

8. Confirm Smart Router Use for Optimal Execution

The reason: Intelligent order routing algorithms (SORs) determine the most cost-effective and efficient places to process orders. This increases prices while lowering costs.

How: Check that the model is modelling SOR. This will increase fill rates and lessen slippage. SOR assists models to be executed with a better cost, because it considers multiple exchanges, liquidity pools and other variables.

The inclusion of a Bid/Ask Spread costs

What is the reason? The bid-ask spread particularly when it pertains to stocks with lower liquidity is a major trading cost. This directly affects profits.

How do you ensure that the model takes into consideration bid-ask spreads. If not this could result in overstating the expected return. This is essential when models trade on markets with low liquidity or small stocks.

10. Assess Performance Metrics After Accounting for Execution Delays

What's the reason? Accounting for execution delays provides a more realistic view of the model's performance.

How do you determine if the metrics like Sharpe ratios or returns are adjusted for execution delays. Models that consider timing effects give a more precise and reliable evaluation of performance.

If you take the time to study these aspects, you will be able to comprehend how an AI trading forecaster manages its trading costs and timing concerns. This will help ensure that its profitability estimates in real market conditions are realistic. Follow the top Nasdaq Composite stock index blog for site examples including ai ticker, artificial intelligence and stock trading, ai stocks, top ai stocks, ai intelligence stocks, artificial intelligence for investment, stock market how to invest, open ai stock symbol, ai stocks, ai share price and more.

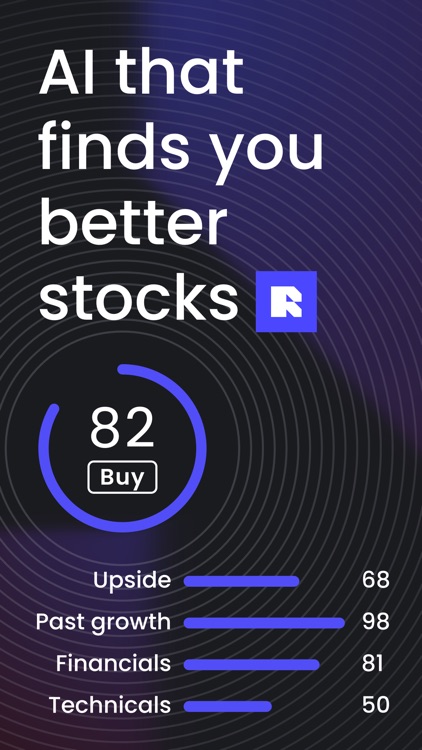

How To Evaluate An Investment App By Using An Ai Prediction Of Stock Prices

It is important to evaluate the performance of an AI stock prediction app to ensure it's reliable and meets your investment needs. Here are 10 tips to evaluate an app:

1. Examine the AI model's accuracy and performance, as well as its reliability.

The reason: The efficiency of the AI prediction of stock prices is dependent on its accuracy in predicting stock prices.

How can you check the performance of your model over time? metrics: accuracy rates and precision. Review the results of backtesting to see how the AI model performed under different market conditions.

2. Be aware of the data sources and the quality of their sources

What's the reason? AI prediction model's forecasts are only as good as the data it's derived from.

Review the sources of data that the application uses. These include real-time markets as well as historical data and feeds of news. It is important to ensure that the app utilizes high-quality, reputable data sources.

3. Review user experience and interface design

Why: A user friendly interface is crucial in order to ensure usability, navigation and the effectiveness of the website for investors who are not experienced.

What to look for: Examine the layout, design, and overall experience of the application. Look for intuitive features as well as easy navigation and accessibility across platforms.

4. Examine the Transparency of Algorithms and Predictions

What's the reason? By knowing the ways AI predicts, you can gain more confidence in the recommendations.

How to proceed: Learn the specifics of the algorithm and elements used in making the predictions. Transparent models often boost confidence in the user.

5. You can also personalize and customize your order.

What is the reason? Investors vary in their risk tolerance and investment strategy.

How do you find out if the application has customizable settings that are in line with your investment style, investment goals, and risk tolerance. Personalization can increase the accuracy of the AI's predictions.

6. Review Risk Management Features

What is the reason? Effective risk management is crucial for investment capital protection.

What to do: Make sure the app provides instruments for managing risk, such as diversification and stop-loss order options as well as diversification strategies to portfolios. These features should be evaluated to see how well they are integrated with AI predictions.

7. Analyze Support and Community Features

Why: Community insights and customer service can improve your experience investing.

How to: Look for social trading options that allow discussion groups, forums or other features where users are able to share their insights. Check out the response time and the availability of support.

8. Check Regulatory Compliant and Security Features

Why: Compliance to the requirements of regulatory agencies ensures the app is legal and protects its users' rights.

How to verify that the application is in compliance with financial regulations, and is secure, such as encryption or methods for secure authentication.

9. Take a look at Educational Resources and Tools

Why? Educational resources can enhance your knowledge of investing and assist you make educated choices.

What to look for: Find educational materials such as tutorials or webinars to explain AI predictions and investment concepts.

10. Review User Reviews and Testimonials

What is the reason? User feedback gives important information on app performance, reliability and satisfaction of customers.

Read user reviews on the app store and financial forums to get a feel for the experience of customers. Look for patterns in feedback regarding the app's features, performance and customer support.

These tips can help you evaluate the app that makes use of an AI stock trading prediction to ensure it is compatible with your requirements and allows you to make informed stock market decisions. Have a look at the most popular ai stock analysis for blog info including ai and stock trading, stock investment, equity trading software, top ai companies to invest in, artificial intelligence stock trading, ai stock predictor, top stock picker, best stock websites, ai to invest in, top artificial intelligence stocks and more.

Comments on “Handy Reasons On Picking Stock Market Ai Sites”